Types of Crypto Exchanges Explained

The cryptocurrency market is ever-blooming. In 2025, it is estimated to have a whopping revenue of $45.3 billion. People have acknowledged the wide range of crypto investing benefits—higher liquidity rates and dynamically changing market valuation top the list. Crypto transactions are also highly secured, thanks to the blockchain network. Investing in cryptocurrencies can yield excellent returns with time. However, to do so, you will need cryptocurrency exchange software.

These online platforms allow investors to buy, sell, and trade using cryptocurrencies. Understanding the types of crypto exchanges is crucial before you start your investment journey. Without gaining complete knowledge, you may end up with an exchange platform that won’t give you full freedom. Besides, there may be risks of security and crypto theft. That being said, we have prepared a detailed guide here on the types of crypto exchanges currently prevailing. This will provide you with the comprehensive knowledge needed to make the right call.

What Are Centralized Exchanges (Cexs)?

Definition and Functionality

Centralized exchanges are intermediaries. They store the private keys of all users and connect buyers and sellers. Suppose you are a buyer. You create an account on the exchange using your credentials. Once you log in to the exchange, you will get access to different bids from crypto sellers. Centralized exchanges do not require users to write command line prompts or create instructions for the transaction. Instead, they function under a central authority community. This community uses a voting mechanism to determine the functionality and control of the exchange platform.

CEXs are one of the most secure types of crypto exchanges in the decentralized ecosystem. They come with enhanced encryption protocols to keep all the private keys safe. Besides, they work with on a verification process. In other words, transactions need to be authorized before completion. Some of the key characteristics of centralized crypto exchanges are:

- These settle any dispute between the sellers and buyers.

- They work under the governance of a single community.

- Ownership rests with a few people only.

- All the user accounts and profiles are managed by a third-party entity.

- These types of crypto exchanges support both cryptocurrencies and fiat currencies.

- Funds are often placed under escrow services for better security.

- Orders are matched on behalf of the buyers and sellers automatically.

Advantages of CEXs

User-friendly interface

Centralized exchanges are known for their intuitive interfaces. Beginners won’t have to struggle much in navigating around the platforms. Buying and selling of cryptocurrencies are also hassle-free.

Faster transactions

Internal order books are used for proceeding with transactions. In other words, these types of crypto exchanges match buy and sell orders using an internal engine. Hence, transactions are much faster than decentralized exchanges.

Higher liquidity

Trading volumes are quite high on centralized crypto exchanges. As a result, liquidity rates are significantly high, offering excellent returns on investments.

Fiat integration

Most centralized exchange platforms allow fiat-to-crypto conversions and vice versa. As a result, investors can buy crypto tokens using traditional financial rails.

Advanced trading features

Users can enjoy numerous advanced trading features on centralized exchanges. For instance, they can work with both margin and Futures trading strategies to maximize their gains.

Security measures

A two-factor authentication protocol is integrated with most centralized crypto exchange platforms. Funds are distributed with escrow services to provide optimal user protection.

Disadvantages of CEXs

Custodial risks

Private keys are stored within these types of crypto exchanges. Also, users do not have complete control over their fund holdings. Hence, they are at higher exposure risk to hackers and cybercrimes.

Regulatory compliances

Centralized exchanges abide by government rules and regulations. Hence, users cannot deal anonymously. They need to verify their identities through KYC authentication.

Potential account freezing

If any suspicious activity is detected, fund holdings can be frozen. This will restrict users from accessing their funds or accounts on the centralized exchange platforms.

Higher fees

Transaction fees are quite high on CEXs. The fees skyrocket further when fiat currencies are involved in the crypto transactions.

Single point of failures

CEXs operate on centralized protocols. Hence, these platforms are vulnerable to system failures. Failure to comply with regulations can also disrupt all operations.

What Are Decentralized Exchanges (Dexs)?

Definition and Functionality

One of the most popular types of crypto exchanges is the decentralized platform. As the name sounds, these platforms facilitate peer-to-peer transactions. Blockchain technology serves as the underlying controlling engine for all transactions. contracts are used for validating transactions and further execution. Hence, intermediaries like banks and other organizations are eliminated from the picture. Thanks to the blockchain ledger, users can have complete transparency on their fund holdings and movements.

There are two types of crypto exchanges under the DEX category. These are:

- Order book DEXs: These use an on-chain order book to match buy and sell orders internally. All the transaction details are posted on the blockchain for greater security. thanks to Layer 2 blockchain integration and ZK rollout, order book DEX has become quite popular.

- Automated Market Makers: An AMM uses a liquidity pool for matching the buy and sell orders. Users can easily swap their crypto tokens based on a pre-determined price. An algorithm is used for price determination in AMMs. It considers the proportion of a specific crypto token in the pool to alter the exchange price.

Advantages of DEXs

Higher security

Decentralized exchanges don’t hold the funds of the users. As a result, risks of hacking and illegal thefts are reduced significantly. Besides, users have complete control over their private keys.

Non-custodial

These types of crypto exchanges work on a non-custodial model. In other words, they give users full control over their funds and private keys. Hence, risks of theft and exposure can be reduced.

Anonymity and privacy

The decentralized exchanges do not abide by government regulations and rules. Hence, users can maintain their anonymity while trading and investing in cryptocurrencies. No KYC verification is required for account creation.

Censorship resistance

Changes in government policies will have the least impact on DEX operations. These platforms are decentralized and permissionless. Hence, they don’t need censorship to conduct their functions.

Lower transaction fees

Layer 2 blockchain integration can lower the transaction fees of decentralized crypto exchanges. Hence, users can maximize their returns easily without worrying about surged gas fees.

Higher token availability

Any new crypto token launched in the market will be automatically listed on the DEX. That’s because these platforms do not need approval from any central authority for listing crypto tokens.

Disadvantages of DEXs

Lower liquidity rates

Trading volume is not as high as that of centralized exchanges. As a result, users may not have high liquidity rates often on DEXs.

Complex UI

These types of crypto exchanges are best for seasoned investors and traders. Their complex user interface may not be feasible for beginners. Besides, users should have detailed knowledge about gas fees, smart contracts, and blockchain.

No fiat integration

Users cannot access fiat currencies on decentralized exchanges. They will have to purchase crypto tokens beforehand. Only then they can use the DEXs for investments and trades.

Limited advanced features

Decentralized exchanges often lack advanced trading features. For instance, the stop-loss order feature is often absent from most DEXs.

Slow transaction speed

If the Layer 2 blockchain is not integrated, transaction speed can be quite slow. This automatically increases the gas fees and slows down network activities.

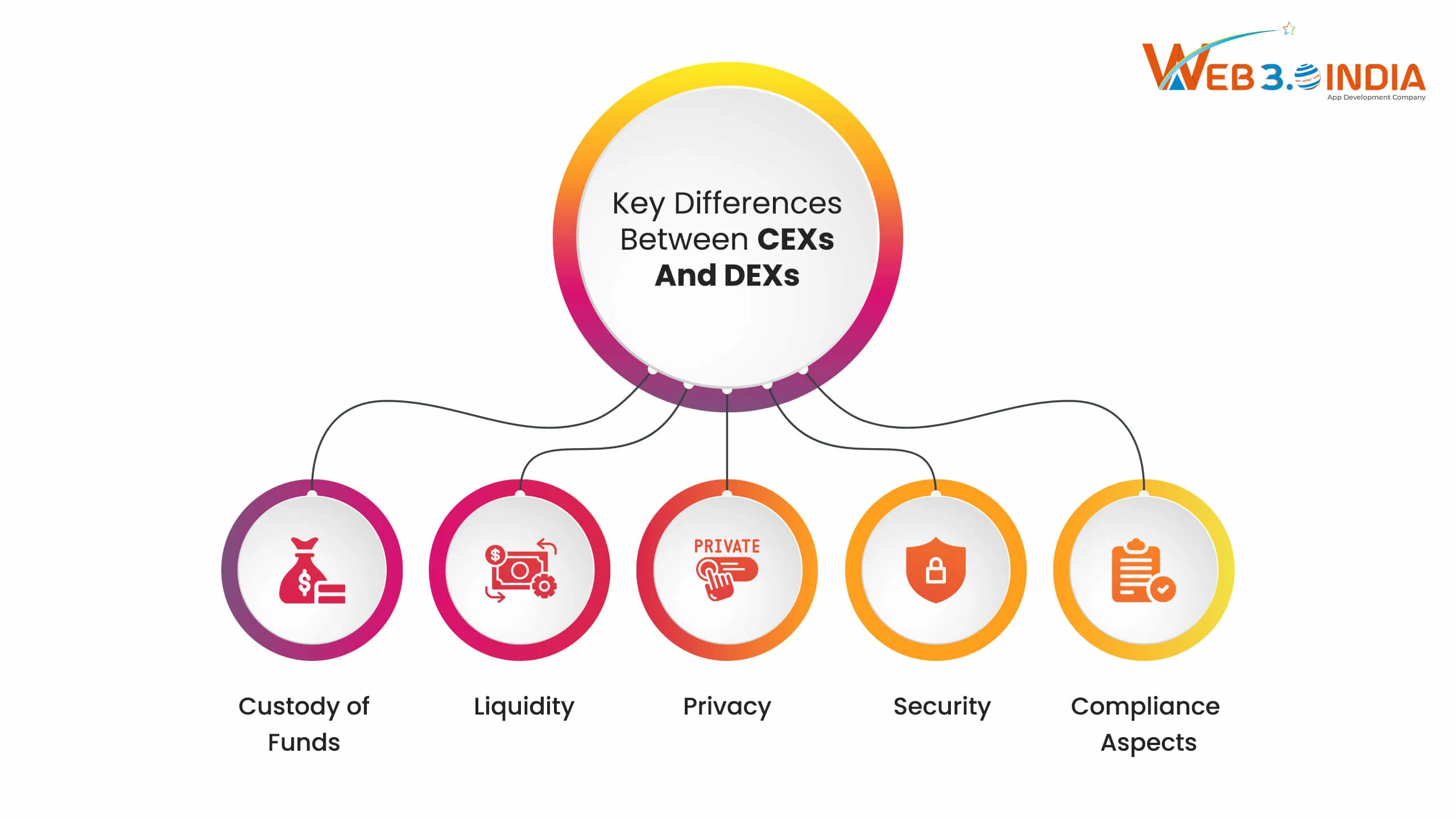

Key Differences Between CEXs and DEXs

Choosing the Right Exchange for Your Needs

Since there are two types of crypto exchanges, deciding the most feasible one can be troublesome. So, we have briefly explained which one will be better for you.

When to choose a CEX?

- If you are a beginner, centralized exchanges will be of great help.

- CEX will be best for traders wishing to access both cryptocurrencies and fiat currencies.

- For faster transactions and higher liquidity, CEX will be the best option.

- If you are looking for advanced trading features, look for centralized exchanges.

- If you want to trade with authorized crypto tokens, CEX will be a safer option.

When to choose a DEX?

- Decentralized exchanges are suitable for seasoned investors and traders.

- If you already have crypto tokens, you can easily use DEXs.

- If liquidity rate is not a concern for you, go with decentralized exchanges.

- For basic trading features, decentralized exchanges are indeed the best option.

- If you want to invest in new crypto tokens, DEX will give you access to their listings.

Conclusion

Understanding the types of crypto exchanges is crucial for both beginner and seasoned investors. This will allow you to capitalize on their features and maximize your returns. However, you should verify if the chosen exchange is reliable or not. For this, check the security features, like 2FA, escrow services, KYC verification, and more. Also, go through the online reviews to gain valuable insights about both DEX and CEX before making the choice. At Web 3.0 India, we help investors navigate the crypto landscape with expert insights and secure solutions. Start your journey with confidence!